The vice-president of the Saskatchewan Research Council’s rare earth processing division says he’s confident the Saskatoon facility will succeed where Vital Metals failed.

“We are constructing a vertically integrated rare earth processing facility. In short terms, we call it ‘mineral to metals,’ ” said Dr. Muhammad Imran.

Vital Metals, an Australian mining company, declared bankruptcy at its Saskatoon location in late September 2023, about a year after the federal government invested in it. Associated costs tripled to around $60 million from an initial $20 million.

In late December, all of the company’s equipment — much of it brand new — was liquidated in an auction that closed on Jan. 12. According to McDougall Auctioneers, mining companies from around the world flocked to Saskatoon to quickly snatch up the equipment that was sold for pennies on the dollar.

That left the SRC as the sole potential rare earth minerals processor in the province.

SRC rare earth processing vs. Vital Metals

It was in August 2020 that the province announced a $31-million investment into its own rare earth processing facility.

According to a spokesperson from the SRC, the cost of the facility is now $71 million, but “remains on time and on budget.”

Imran explained the increase as an “added scope.”

“When we started this project, interestingly, at that point, we were only looking at processing two steps,” he said.

Imran explained that those first couple of steps occur when rare earths are separated from impurities. During the second step, the different types of rare earth minerals are separated from one another.

“Looking at the market volatility over the past two years, we realized that’s not going to be enough. We’ve got to look into further processing,” Imran added.

The SRC has secured 900 tonnes of a radioactive material called monazite, which looks like black sand, from Brazil.

The cost to process that monazite has gone from $1,000 a tonne to $13,000 a tonne in the last three years. Add to that shipping costs for radioactive material and it comes out to around $19,000 to produce a liquid from which a variety of rare earth minerals can be extracted.

The market price of that liquid is just $5,000 per tonne, and that was the end product that Vital Metals was going to produce from a very similar material called bastnaesite.

“So you lose a lot of money,” said Imran. “So that’s the importance of the vertical integration and that’s where one of the differences between our facility and Vital Metals.”

Imran said the next step in the SRC’s process is to convert that liquid into different elements, through a closely guarded solvent extraction process using Artificial Intelligence and automation which reduces the need for human labour by about 90 per cent.

Those four elements can be turned into metals through a unique smelting process.

“In summary, we looked at every single step where the economical viability can be demonstrated,” Imran said. “Our facility continues with the process.”

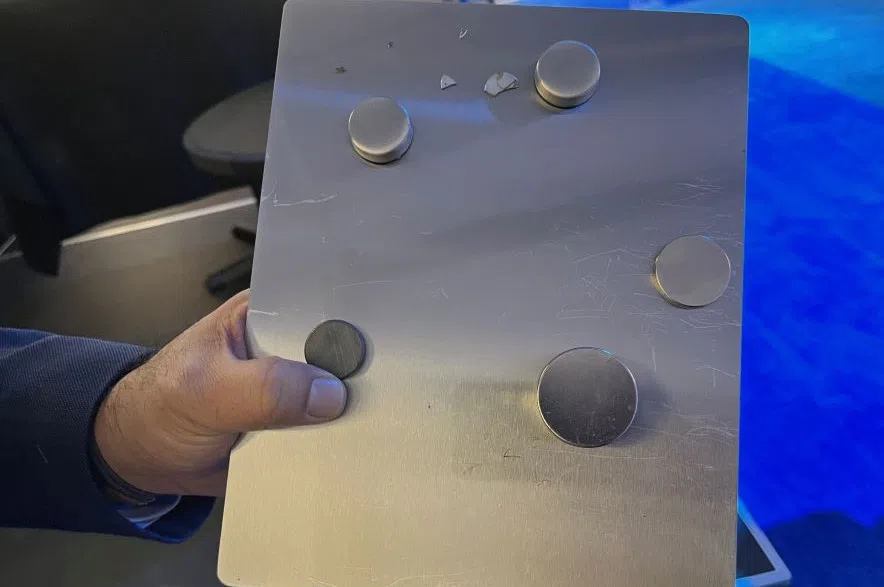

The goal of the Saskatoon facility is to manufacture metal ingots for permanent magnets that are used in electric vehicles and for a host of other uses.

Rare earth mining and production in Saskatchewan

While Saskatchewan is rich in uranium and potash, it’s also thought to potentially be a significant source for rare earth materials, including monazite.

“The resource has not been defined yet,” said Imran. “One (mine) is on the northwest side … They’re still in the process of defining the net resource.”

Exploration is still in the geophysical stage and won’t likely be completed for another five to 10 years. That’s why the raw material must be sourced from other countries.

“Going forward we are in discussions with various countries which will be supplying us monazite for at least the next five years,” said Imran.

So what happens if the supply dries up or becomes too expensive? Imran says the SRC facility can begin processing at virtually any stage, and the operation can pivot if necessary.

The ingots are sent to other markets for processing into magnets used in EV production. (Lara Fominoff/650 CKOM)

“If we cannot get our monazite, we get our mixed rare earth carbonate, our chloride. If we cannot get the carbonate, we can buy rare earth oxide,” he said.

The entire process from processing the raw monazite to a finished ingot will take about two days. Once up and running in late 2024, the facility will require about 3,000 tonnes of raw monazite per year to produce about 400 tonnes of neodymium and praseodymium, or NDPR metal.

It’s hoped that metal will then likely be sent to markets in the U.S., Europe and Asia to be used in creating some of the strongest types of rare earth magnets that will be used in the manufacturing of half a million electric vehicles and other industrial processes per year.

“The end result is to demonstrate techno-economic viability,” said Imran. “It will demonstrate it can turn a profit.”

But what that profit might be is anyone’s guess. According to a follow-up statement from the SRC, that’s up in the air.

READ MORE:

- Minister still confident in SRC rare earth facility after Vital Metals pause

- Hunt for lithium drives subsurface mineral public offering in Sask.

- Saskatchewan poised to become North American leader in rare-earth metals

“The rare earth market is extremely volatile and at this point it is difficult to state how much revenue SRC will generate once in production, as it will vary based on those variable market factors,” the statement said.

The long-term goal by 2035 is for the rare earth element sector to produce 50,000 tonnes per year of NDPR.

“This is the starting point,” said Imran.

EDITOR’S NOTE: This story has been updated to correct a misspelling of monazite.