A Saskatchewan woman is one of many feeling frustrated by the federal government’s refusal of a Type 1 diabetes tax credit.

The $1,500 credit is supposed to help offset the bills that accompany the costly disease.

Cora-lynn Hannah, whose eight-year-old son Lucas was diagnosed four years ago, said it’s hard to keep up with the bills.

“It’s scary because this is life or death for my child and the government is playing with that – and that’s just so not fair,” Hannah said.

Hannah, who lives in Oxbow, started receiving the tax credit last year. She noticed they weren’t getting it anymore in July.

“It’s a very expensive disease to have and it sucks because it’s not like you can prevent it.”

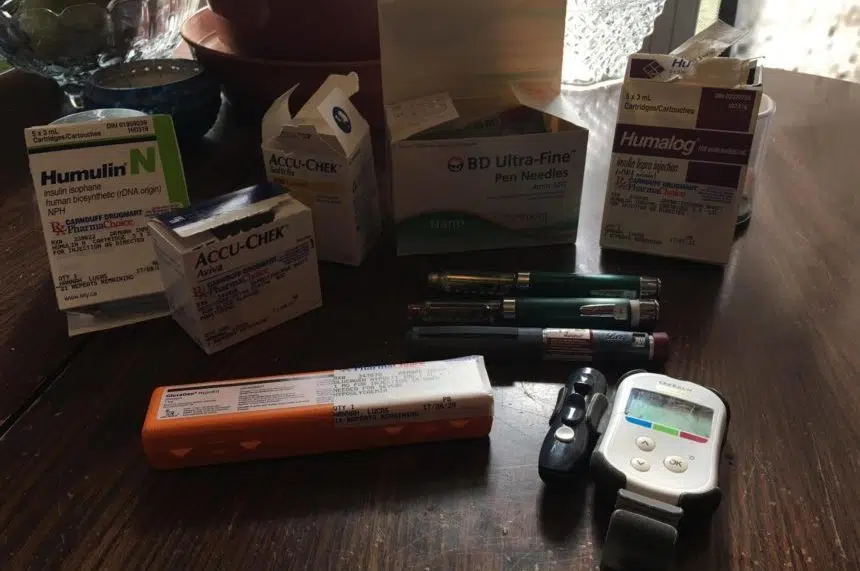

She pays around $300 a month for testing strips to check her son’s blood glucose levels. Hannah noted that’s with insurance, and the price goes up when Lucas gets sick.

“It is crazy the amount of money that you have to pay for a Type 1 diabetic to keep them alive,” she said. “Now what? You know, what are we going to do now? How are we going to afford all this stuff we need for him?”

Hannah considers herself lucky because her son’s insulin is covered. But the cost accumulates when she calculates how much she spends on stocking her son’s elementary school with specific snacks and strips.

Hannah said she was planning to use the tax credit this year to purchase a machine to replace the strips.

“We wouldn’t have to test his fingers all the time. It’s a little machine that hooks onto their belly or their arm and it continuously checks over five minutes their glucose numbers,” Hannah said.

She added it would give his teachers a peace of mind and would allow her to sleep at night.

“I have to test him at midnight, again at 3 a.m. and again at 6 a.m. to make sure he doesn’t have a low at night or, you know, he could possibly die in the night,” Hannah said.

She noted with the new device she can received updates on her son’s levels right to her phone.

Currently, she’s waiting to know why the tax credit stopped for her son.